(g+)economics in the news (continued)

Bloomberg TV: Komileva: Yellen Hawkish as Could Be Without a Jolt (29/08/16)

DowJones News: Bond Report - Treasurys On Tenterhooks Ahead Of Yellen Speech (26/08/16)

MarketWatch: FTSE 100 wavers, but miners find relief after selloff (26/08/16)

Bloomberg TV: Brexit Containment Measures Remain Uncertain: Komileva (14/08/16)

FT: Yen races higher after BoJ disappoints (29/07/2016)

WSJ: Draghi Stops Short of Pledging Fresh Stimulus (21/07/2016)

MarketWatch: One reason the stock market has been so dang resilient (21/07/2016)

Dow Jones Business News: ECB Open to Further Stimulus at September Meeting (21/07/2016)

Reuters News: Hammond to face Brexit grilling at G20 (20/07/2016)

Bloomberg TV: Will Erdogan Use Coup Attempt to His Advantage? (18/07/2016)

Reuters: Turkey coup impact seen limited but instability fear remains (17/07/2016)

FT: Turkey and risk appetite set tone for markets this week (17/07/2016)

Gestiona Tu Dinero: La inestabilidad en Turquía aumenta la aversión al riesgo (17/07/2016)

Bloomberg TV: Italy’s Banking Woes Spark Fears of Market Contagion (07/07/2016)

Bloomberg TV: The Brexit Impact on Halting Property Funds (07/07/2016)

The Telegraph: What does a falling pound mean for the British economy? (06/07/2016)

Bloomberg TV: The Fed Is Risk Averse Right Now, Says Komileva (06/07/2016)

Die Welt: UK referendum on the European Union erodes British economic pillars - recession fears (06/07/16)

Eleconomista.es: El Brexit ya está erosionando los pilares económicos de Reino Unido (06/07/16)

Bloomberg: Brexit Erodes U.K. Economic Pillars, Property Investors Flee (05/07/16)

FT: Brexit vote fuels wave of risk aversion (24/06/16)

Bloomberg TV: Komileva - Eurozone Has Regained Its 'Mojo' Since Crisis (10/06/16)

Bloomberg TV: Will Negative Rates Eventually Backfire? (09/06/16)

Bloomberg TV: Will Recession Come With a Brexit Vote? (09/06/16)

FT: Dollar tumbles after weak US jobs data (04/06/2016)

Bloomberg Best: Why Draghi's Interest Rate Comments Are So Important (02/06/2016)

Bloomberg TV: Investors Wish Oil Price Was Stronger, Says Komileva (02/05/2016)

Bloomberg TV: Topix Tumbles Most in 11 Weeks (02/05/2016)

Bloomberg News: Oil Falls below $45 in New York as Iraq Exports Approach Record (02/05/2016)

WSJ: Economists React to the Fed Decision: ‘More Optimistic…Than in March’ (27/04/16)

Investing.com: Negative Blowback from Negative Interest Rates (27/04/16)

WSJ: ECB Leaves Door Open for Further Interest-Rate Cuts (21/04/16)

Bloomberg TV: Global Economy Imbalanced on Inflation Divergence (04/04/16)

Bloomberg TV: Markets Show Doubts of Withstanding Stronger Dollar (04/04/2016)

Bloomberg TV: Markets Not Reflecting Economic 'Brexit' Risks – Komileva (04/04/2016)

Dow Jones Newswires: 10-year Treasury yields post largest weekly decline in 2 months (01/04/16)

The Telegraph: Britain courts fate on Brexit with worst external deficit in history (31/03/16)

Sky News: Pressure On Consumers To Drive Growth, Despite Record Low Savings (31/03/16)

Dow Jones: US dollar remains under pressure after Yellen and Draghi (31/03/16)

Bloomberg Radio: Komileva: Fed is Risk-Dependent - Dollar funding is critical for market volatility and economic health this year. That’s according to Lena Komileva, Chief Economist and Managing Director at G+Economics who spoke to First Word Europe’s Guy Johnson and Jonathan Ferro, as investors digest uncertainty surrounding the next Fed rate hike. She explained that the Fed policy bias is risk-dependent, despite the central bank iterating its data focus (29/03/16)

Bloomberg News: Brussels Attacks Add to Political Obstacles for Cameron, Merkel (22/03/16)

Bloomberg Radio: ECB’s Draghi faces an uphill struggle (09/03/16)

Bloomberg Surveillance: The necessity & side effects of negative interest rates (07/03/16)

Bloomberg Surveillance: Brexit is weighing in on investor sentiment (07/03/16)

FT: US jobs data fuel fresh gains for Wall Street (05/03/16)

The Independent: Strong US jobs figures spark talk of another rise in rates (05/03/16)

FT: Wall Street struggles after strong rally (02/03/2016)

Citywire: Royal grumble: why the Queen would question messed up markets (26/02/16)

Financial News: Banks' stock rout poses new dilemma for Draghi (18/02/16)

Bloomberg TV: Financial Stability - Central Banks' Third Mandate (16/02/16)

Bloomberg TV: The End of the Line for the US Dollar Rally (16/02/16)

Bloomberg TV: Can the Yen Withstand BOJ's Move to Negative Rates? (16/02/16)

Dow Jones: ECB won’t hesitate to boost stimulus: Mario Draghi (15/02/16)

FT: Yield curve recession indicator sends warning on US economy (12/02/16)

Reuters: Yield curve moves flash global recession warning signs (05/02/16)

Bloomberg Radio: The First Word -Komileva on Global Economy (04/02/16)

Bloomberg TV: Negative Interest Rates: a Risky Move for the BoJ? Lena Komileva, managing director and chief economist at G Plus Economics, discusses the Bank of Japan adopting negative interest rates and what it means for the economy. She speaks to Bloomberg's Anna Edwards and Manus Cranny. (29/01/16)

MarketWatch: Bank of Japan’s negative rate decision is a mark of ‘desperation’ (29/01/16)

Fortune: Japan Joins The Negative Interest Rate Club (29/01/16)

FT: Draghi’s dovish comments – economists react (21/01/16)

DJ/WSJ Market Watch: 4 key takeaways from Draghi’s ‘no limits’ statement (21/01/16)

FT: Mark your calendars for March easing from ECB (21/01/16)

Greece: Markets Need to Get Ready for a Default – BBC

"What Syriza is proposing is radical, but there's no certainty about how it's going to be funded" - Lena Komileva pic.twitter.com/0GaXE7tkJ7

— BBC Breakfast (@BBCBreakfast) January 26, 2015

Bloomberg TV: Komileva says Russian economy is in transition

FT: German short-term sovereign debt yields fall to record low (03/12/15)

MarketWatch: FTSE 100 yanked lower as ECB stimulus disappoints (03/12/15)

Reuters: Will ECB's Draghi ever raise rates? Maybe in 2019 (01/12/15)

The Telegraph: Euro jumps and markets drop after ECB stimulus boost disappoints (03/12/15)

FT: Euro surges past $1.08 after ECB announcement (03/12/15)

Reuters: ECB anti-climax takes shine off Draghi (03/12/15)

fastFT: ECB's Draghi disappoints: A wrap-up of market reactions (03/12/15)

MarketWatch: Here’s how the ECB’s stimulus plans disappointed markets (03/12/15)

WSJ: Morning MoneyBeat Europe: Here Comes Draghi (03/12/15)

Bloomberg TV: What's Priced in Ahead of the ECB Meeting? (30/11/15)

European CEO: The Eurozone crisis isn’t going away any time soon. European CEO caught up with Lena Komileva of G+ Economics to find out where the trouble spots are for the Eurozone and what countries are leading its economic recovery (27/11/15)

25 June (Bloomberg) - Greece: Markets Need to Get Ready for a Default: Komileva

FT: Wall St extends gains after Fed minutes (19/11/15)

FT: Cautious trade dictates European markets (18/11/15)

Bloomberg TV: ECB, Fed Policy Divergence Has Still Not Materialized (12/11/15)

FT: US stocks slip as Fed rate talk persists (05/11/15)

Bloomberg TV: The Structural Flipside of Lagarde's 'New Normal' (12/10/15)

Bloomberg TV: The Positive Economic Boost of Europe's Refugees Crisis (12/10/15)

Citywire: How China’s economic miracle could end in domino effect of defaults (08/10/15)

Citywire: The day after the Fed raises rates and the effectiveness of the ECB's QE (08/10/15)

FT: Dovish Draghi hits euro and Bund yields (03/09/15)

WSJ: ECB left rates unchanged, but the bank appeared to move closer to expanding its QE program (03/09/15)

FT: Euro punished after Draghi’s dovish message on ECB action (03/09/15)

Reuters: Global Markets - Stocks rally but investors wary before ECB forecasts (03/09/15)

fastFT: Draghi gives bonds a leg up (03/09/15)

WSJ: G+ Economics Expects Cautious Tones From ECB — Market Talk (03/09/15)

Foreign Policy: Another Bailout Won't Keep Greece in the Eurozone (14/08/15)

BBC Radio 4 Today: Komileva discusses the third Greek bailout and the prospect of a second Greek snap election (13/08/15)

BBC Radio 5 Live Wake Up to Money: Lena Komileva discusses euro break-up risk and Greece with BBC business correspondent David Jones (12/08/15)

Bloomberg Radio First Word: Komileva on weak ahead (10/08/15)

Reuters: Dollar falls, but outlook still positive on rate hike view (07/08/15)

FT: Dollar firms amid US rate rise speculation (06/08/15)

WSJ: “Super Thursday” hits sterling as BoE says no imminent rate moves (06/08/15)

The Telegraph: The BoE’s “Super Thursday” (06/08/15)

FT: Stocks in retreat after recent strength (21/07/15)

BBC: Grexit "still very much on the table" (16/07/15)

Bloomberg TV: Greece Is More Out Than In the Euro Zone: Komileva (14/07/15)

Bloomberg Surveillance: Komileva, Zimbalist and Malkoutzis (13/07/15)

Bloomberg: "The First Word" - Komileva on Greece (06/07/15)

MarketWatch/WSJ: US Labor-force participation drops to lowest level since 1977 (02/07/15)

FT: Greek uncertainty hits European stocks (30/06/15)

CNBC: Lena Komileva, chief economist for G+ Economics, talks about the risks of contagion in Europe's economy (29/06/15)

Bloomberg TV: Greece - Markets Need to Get Ready for a Default - Komileva (25/06/15)

Bloomberg TV: Without ECB Support, 'Grexit' Is Inevitable: Komileva. G Plus Economics Chief Economist and Managing Director Lena Komileva discusses the Greek debt crisis with Bloomberg's Anna Edward on "Countdown." (25/06/15)

Bloomberg TV: G Plus Economics Chief Economist Lena Komileva discusses U.S. interest rates and when she thinks the fed will raise them. She speaks to Bloomberg's Anna Edwards on "Countdown" (24/06/2015)

BBC Breakfast TV: Lena Komileva discusses latest EU-Greece progress with BBC Markets and Economics correspondent Ben Thompson (23/06/15)

BBC Radio 4 Today: Deal or no deal - Greece offers last-minute proposals ahead of emergency EU Summit (22/06/15)

Jornal de Negócios – Portugal: Lena Komileva: "Liquidez excessiva levou à subavaliação do risco" (11/06/15)

Noticias ao Minuto: Lena Komileva "Riscos financeiros não estão descontados nos mercados" (11/06/15)

Jornal de Negócios – Portugal: Komileva : BCE "vai estender os estímulos" além de 2016 (10/06/15)

FT: Stocks undermined by bond volatility (05/06/15)

Reuters: US 10-year yield at seven-month peak (05/06/15)

MarketWatch: Germany's bond rout is a taste of things to come (04/06/15)

Bloomberg TV: European Rate Decision Day (03/06/15)

Reuters: Yields rise to three-week peaks in line with German bonds (03/06/15)

MarketWatch: ECB Live Blog (03/06/15)

Reuters: US yields rise to three-week peaks in line with German bonds (03/06/15)

FT: Dollar’s correction extends for a third week (08/05/15)

The Independent: Election results - Poll result electrifies markets, but fears over British EU exit remain (08/05/15)

Bloomberg TV: U.K. Will See a Rate Hike by End of the Year: Komileva (04/05/15)

Businessweek/Bloomberg: Negative Interest Rates Become the Norm in Europe (04/05/15)

FastFT: Dollar sinks after US GDP disappoints (29/04/15)

WSJ: European Stocks Plunge as Euro Rises on Poor U.S. Growth Data (29/04/15)

Reuters: Bund yields post biggest rise in 2 years on improving data, Greece mood (29/04/15)

FT: Wall St sets records as Nasdaq powers on (25/04/15)

FT: Hard Currency podcast - G+ Economics’ Lena Komileva says it is The Waiting Game for the US Dollar when it comes to the Fed’s first rate hike (23/04/15)

Bloomberg Businessweek: The Death of Cash (23/04/2015)

FT: UK gilts lead government bond sell-off (21/04/15)

Bloomberg: Banks get paid to borrow as 3-month Euribor drops below zero (21/04/15)

Reuters: Greek yields touch two-year highs on bank funding worries (21/04/15)

FT: Euro swaps benchmark fixed at a negative rate (21/04/15)

Il Sole 24 Ore: La Bce a Italia Francia: ripresa in vista, fate più riforme (21/04/15)

FT: Euro swaps benchmark fixed at a negative rate (20/04/15)

MarketWatch: Investors may be ignoring potential ‘collateral damage’ from Greece (20/04/15)

FT: Greek short-term bond yields hit another high (20/04/15)

FT: US and European stocks bounce back (20/04/15)

Reuters: Dollar slide helps pound recover some poise (14/04/15)

Bloomberg TV: Greece Heading for Debt Swap After Cash Help: Komileva (10/04/15)

BBC Radio 4 Today programme: Greece has switched from "negotiation to provocation", says Lena Komileva, managing director G+ Economics (08/04/15)

BBC World Business Report: Is Grexit Now '50-50'? BBC World Service examines Greece's latest efforts to escape the financial precipice with Lena Komileva of the economic analytics group, G+ Economics (08/04/15)

Prospect Magazine’s first General Election 2015 debate titled “Austerity: who's right?” Speakers include: G Magnus, Economist and author, Lena Komileva, Managing Director at G+ Economics, Paul Johnson, Director of the institute for Fiscal Studies and Prospect Editor, Bronwen Maddox (25/03/2015)

FT: Global stocks struggle for clear trend (24/03/15)

CSFI 2015 City Round Table: European “currency wars”. A breakfast discussion with Daniel Murray (EFG Asset Management), Anezka Christovova (Credit Suisse), John Plender (FT) and Lena Komileva (G+ Economics) (18/03/15)

The Telegraph: Defiant Greece at daggers drawn with EU creditors (10/03/15)

Bloomberg TV: Komileva: Why I'm Optimistic About Europe (06/03/15)

FT: Dollar and US bond yields soar after data (06/03/15)

WSJ/ MarketWatch: The ECB and Greece (05/03/15)

Reuters News: Euro zone inflation bets rise as data challenges deflation outlook (04/03/15)

Barron's: Yellen Talks, Markets Yawn (28/02/15)

FT: S&P 500 hits record after Yellen remarks (24/02/15)

Bloomberg: Greek Deal Kickstarts Best Day Since QE for Periphery’s Bonds (23/02/15)

Bloomberg: Greek Deal Sparks Bond Rally Powering Portugal Yields to Record (23/02/15)

Ekathimerini.com: Greek bonds may lead periphery higher after funding deal struck (22/02/15)

Bloomberg: The Real Battle Over Greece Still Lies Ahead (21/02/15)

Bloomberg: The First Word: Komileva on Fed (20/02/15)

BBC 24 News and Business Report: Lena Komileva discusses the emergency Eurogroup meeting & Greece negotiations (11/02/15)

BBC Radio4: Lena Komileva discusses “Grexit” and global central banks “Currency Wars” on the Today programme (09/02/15)

BloombergTV: Greece's `Risky' Plan May Lead to New Vote: Komileva (02/02/15)

Bloomberg: ECB Bond-Buying Plan Has Investors Questioning How It Works (01/02/15)

MarketWatch: The reason a strong dollar is hurting stocks right now (28/01/15)

BBC World Business Report: Europe Reacts to Greek Election (27/01/15)

Bloomberg: Greek bonds slip on Syriza victory as ECB buying mutes contagion (26/01/15)

BBC Breakfast: Lena Komileva discusses the implications of the Greek lections with Steph McGovern, Bill Turnbull and Louise Minchin in Manchester (26/01/15)

Reuters: European borrowing rates collapse after ECB launches QE, euro sinks (23/01/15)

CNN Money: Greece elections: Have 5 years of austerity paid off? (22/01/15)

Bloomberg: European Banks Pay to Lend Cash in Credit-Crunch Reversal (19/01/15)

FT: Stocks choppy as oil prices fall further (12/01/15)

The Independent: Greek fears push euro to nine-year low against dollar (06/01/15)

BBC Radio 4 "Today" programme: Could Greece leave the eurozone? (05/01/15)

BBC Radio World Service: Can the Eurozone Cope Without Greece? (05/01/15)

Bloomberg: German inflation slows to weakest since 2009 as ECB plans action (05/01/15)

FT: Economists back Mario Draghi’s call for eurozone action (04/01/15)

WSJ: Choppy global economic outlook (02/01/15)

FT: Euro undermined by Draghi comments (02/01/15)

24 Ore: Le carte di Draghi (31/12/14)

The Bloomberg Advantage: Laszlo Birinyi, Lena Komileva (31/12/14)

Bloomberg: Spain Prices Drop Most Since 2009 as Oil Bedevils ECB Debate (30/12/14)

The Times: Election shortens the odds of Greece exiting the euro next year (30/12/14)

The Telegraph: Greece comes back to haunt eurozone as anti-Troika rebels scent power (29/12/14)

The WSJ: New Greek Elections Loom – What The Market Thinks (29/12/14)

Reuters: Greek bond yields spike after failed vote paves way for poll (29/12/14)

Bloomberg: Fed Crisis Program Becomes China’s $500 Billion Influence Tool (23/12/14)

Toyo Keizai: The Eurozone in 2015 and 2025 (19/12/14)

Bloomberg: Komileva Says Russian Foreign Reserves 'Dwindling' (22/12/14)

Bloomberg: Draghi Counts Cost of Outflanking Germany in Stimulus Battle (18/12/14)

Bloomberg: U.S.-China Economic Role Reversal Roils Emerging Markets (16/12/14)

Bloomberg: Greek Bonds Extend Worst Week Since Euro Crisis (12/12/14)

Reuters: Tepid interest in its cheap loans edges ECB towards printing money (11/12/14)

Barrons: Greece: Bond Opportunity Or Euro Default Risk?(09/12/14)

Reuters: Shares lifted by ECB, Chinese and Japanese stimulus hopes (04/12/14)

Reuters: Draghi – ECB to assess need for more action early next year (04/12/14)

Finantial Times: Stocks jump after China cuts rates (21/11/14)

The Washington Post / Bloomberg: Draghi Ramps Up ECB Stimulus Pledge as Inflation Outlook Weakens (21/11/14)

Reuters: Spotlight falls on Europe's stuttering economy (17/11/14)

The Telegraph: Eurozone dodges triple-dip recession but submerges in 'lost decade'(14/11/14)

Reuters: Carney leads analysts to water, but can’t make all of them think (12/11/14)

Reuters: Europe braces for some dismal figures (09/11/14)

FT: Wall Street slips off highs after US jobs report (07/11/14)

The Telegraph: Mario Draghi's efforts to save EMU have hit the Berlin Wall (06/11/14)

The Wall Street Journal: ECB Needs More Voices, Greater Transparency to Save Euro (06/11/14)

Reuters: Euro zone bond yields tick up as ECB doubts set in (05/11/14)

FT: Resurgent dollar set for sustained rally (03/11/14)

FT: S&P 500 ends at record after BoJ boost (31/10/14)

Barrons: Market Hears Earlier Rate Hike in What Fed Doesn’t Say (30/10/14)

FT: Dollar gains on Fed rate rise bets (30/10/14)

MarketWatch: Economist reactions to Fed statement: Signs of hawkishness (29/10/14)

Die Welt: Finanzmärkten droht der große Kater nach der Party (29/10/14)

FT: Wall Street falters after strong start (22/10/14)

FT: S&P 500 regains 1,900 but nerves remain (20/10/14)

Bloomberg: Euro Economy’s Managers Aren’t Blinking in Market Rout (17/10/14)

FT: Bulls frustrated as S&P 500 pares gain (14/10/14)

FT: Wall St slips as US jobs boost wanes (07/10/14)

FT: Dollar and stocks jump after US jobs data (03/10/14)

Bloomberg: ECB Drops Anchor as Deflation Looms (03/10/14) - Lena Komileva of G+ Economics was the first economist in the market to highlight that the ECB has dropped its historic reference to "anchored" inflation expectations.

Reuters: Faltering demand weighs on euro zone business growth in September (03/10/14)

Bloomberg TV: Lena Komileva, managing director and chief economist at G+ Economics, talks with Guy Johnson about U.S. labor markets, growth, the Fed, the Eurozone, ECB, EUR/USD and the global risk environment. She speaks on “The Pulse.” (03/10/14)

FT: Scotland’s No vote: analysts react (19/09/14)

Bloomberg: Euro-Area Inflation Stays at Five-Year Low Amid Stimulus (17/09/14)

Business Standard: Post-referendum, cost of keeping Scotland in the UK likely to rise (19/09/14)

Il Sole 24: Weak demand for ECB auction/Domanda debole all'asta Bce (19/09/14)

Reuters News: As growth stalls, G20 seeks closure on regulations (18/09/14)

MarketWatch: Fed says it will be ‘considerable time’ before rates are lifted (17/09/14)

FT: Dollar gains ground after Fed statement (17/09/14)

FT: China industrial output data hit markets (15/09/14)

Bloomberg: Hollande Saviour Is ECB as Ex-Partner Adds to Woes: Euro Credit (15/09/14)

International Business Times: Scottish Independence: As Banks Make Dire Warnings, Economists Wait For Details (12/09/14)

Reuters News: Why the world should care about Scottish independence (09/09/14)

FT: Scottish banks lead FTSE lower (08/09/14)

FT: Pound slips on Scottish independence jitters (08/09/14)

Bloomberg: Why Markets Are Voting 'No' to Scottish Independence (08/09/14)

WSJ: Investors fear an independent Scotland, Pound slips (08/09/14)

FT: Euro pummelled after ECB cuts rates (04/09/14)

Reuters: GLOBAL ECONOMY-Factory activity in Europe, Asia cools; demand lull a concern (01/09/14)

FT: Dollar jumps on hawkish Fed bets (20/08/14)

Fortune: Eurozone 2Q GDP flat as German growth engine stalls (15/08/14)

New York Times: Risk of recession looms in anemic Eurozone (15/08/14)

MarketWatch: Get ready for 48 hours of economic fury (28/07/14)

Bloomberg: Treasuries Fall Before Fed Policy Makers Meet, Bond Sales (28/07/14)

Barron's: For US workers Slim Pickings, Indeed (26/07/14)

Reuters: Spanish yields hit record low before bumper debt repayments (25/07/14)

FT: Equities shrug off geopolitical tensions (22/07/14)

FT: Global stocks stabilise after tough week (11/07/14)

Reuters: U.S. hiring may be rebounding, but wage growth is not (07/07/14)

Bloomberg: Draghi Gives Hollande’s Faltering Economy a Leg Up: Euro Credit (26/06/14)

Bloomberg: U.K. Stocks Decline After World Bank Cuts Growth Forecast (11/06/13)

FT: US stocks resume upward path (13/06/14)

Reuters: Euro needs the Fed, or QE, for the next leg down (09/06/14)

FT: S&P 500 at fresh peak after US jobs data (06/06/14)

Bloomberg: Draghi Is Bonds’ Best Friend as Yields Fall to Records (06/06/14)

FT: S&P 500 closes at another record high (31/05/2014)

FT: US stocks hold gains after Fed minutes (21/05/2014)

Reuters: Bank of England officials closer to voting for rate rise, minutes show (21/05/2014)

Bloomberg: What Lurks Beneath? Market Calm Unnerves Global Central Bankers (21/05/2014)

Reuters: Prepare for a razor-thin rate cut from the ECB in June. But what will it achieve? (09/05/2014)

Reuters: Spare cash in euro zone falls below 100 billion euro threshold (24/04/2014)

Reuters: Greek bond yields rise as market comeback euphoria fades (11/04/2014)

FT: Euro undermined by dovish Draghi (03/04/2014)

The Independent: ECB keeps key interest rate at historical low of 0.25% (03/04/2014)

Reuters: ECB set to hold course in face of deflation fears (02/04/2014)

FT: Wall Street advances to record high (01/04/2014)

Reuters: April ECB rate cut; lukewarm praise for bank reform-Reuters Poll (27/03/14)

FT Video - The Auther's Note: Is the world really ready for higher rates? (26/03/14)

Bloomberg: Komileva Says Europe Remains 'Below Escape Velocity' - Audio (24/03/14)

FT: Budget 2014: Pensions shake-up hits insurance stocks (19/03/14)

FT: Equities slide as risk appetite crumbles (03/03/14)

Reuters: Calls grow louder for ECB to print money (27/02/14)

Reuters: World economic recovery struggling to gain traction (20/02/14)

WSJ: For ECB Does Whatever It Takes = Whatever It Wants? (10/01/14)

WSJ: How the U.S. won the global rebalancing game (08/01/14)

Reuters: EU deal to close failed banks won't break 'doom loop' (03/01/14)

Reuters: BoE may lower jobless rate guidance, but not this month (03/01/14)

Reuters: World shares enjoy vintage year‚ seen gaining more in 2014 (30/12/13)

WSJ: Bank Borrowing From ECB Jumps (30/12/13)

Reuters: Fed's taper puts policy on a clear course - economists (20/12/13)

BBC Radio 4 "Today": EU leaders meeting in Brussels have given their backing to a common set of rules for managing the closure of failing Eurozone banks. Lena Komileva, chief economist at G+ Market Economics, examines. Simon Jack interviews (20/12/13)

Financial Times: Global shares rally after taper move (19/12/13)

Financial Times: Stocks jump after robust US jobs data (6/12/13)

Reuters: Euro shines in 2013, complicating deflation fight (2/12/13)

Financial Times: Dollar up as markets ponder taper timing (31/10/13)

Financial Times: Stocks jump after robust US jobs data (6/12/13)

Reuters: Italian, Spanish yields rise on euro zone recovery concerns (25/10/13)

Financial Times: Wall Street recovers from early decline (15/10/13)

BBC 5Live "Drive": US debt talks continue (15/10/13)

BBC World Business Report: US debt ceiling deadlock (15/10/13)

BBC Radio 4 "Today": Interview with Tanya Beckett on the US debt ceiling impasse (15/10/13)

Bloomberg: U.K. Stocks Advance as Investors Watch U.S. Debt Talks (14/10/13)

Reuters: Dollar down as deadlock on U.S. debt deal weighs, yen rises (14/10/13)

Bloomberg: U.S. Budget Impasse Seen Going 'Down to the Wire' (14/10/13)

The Independent: Economy grows, but manufacturing slips (10/10/13)

FT: Markets edgy as US shutdown continues (6/10/13)

Barron's: Winning at "American Roulette" (5/10/13)

FT: Fears of US shutdown weigh on equities (30/09/13)

FT Alphaville: The ECB's very own tapering problem (24/09/13)

The Independent: Angela Merkel's in-tray: Greece, austerity and banking union (24/09/13)

Reuters: Buoyant UK economic outlook, M&A news lift sterling (09/09/13)

FT: Pivotal period looms after summer of QE tension (30/08/13)

Reuters: BoE's cash buffer easing will boost lending (29/08/13)

Reuters: New Greek rescue promises euro drama, not crisis (22/08/13)

Reuters: Greek yields hit three-week highs as Germany says third bailout needed (20/08/13)

Bloomberg/Businessweek: Europe Muddles to German Vote as To-Do List Grows (14/08/13)

FT: Carney's 'forward guidance' baptism of fire at BoE (09/08/13)

Bloomberg: Carney BOE Rates Guidance Meets Investor Skepticism (08/08/13)

Reuters: Markets bring forward UK rate hike expectations after BoE (07/08/13)

Bloomberg: Carney Links Rates to Jobless to Stem Interest-Rate Bets (07/08/13)

Reuters: Bank of England ties rates to jobs, markets unconvinced (07/08/13)

This is Money: Economic revival leaves Bank money-printing on pause - and economists searching for clues on when rates might rise (31/07/13)

Reuters: Sterling slips on in-line UK growth data, BoE uncertainty (25/07/13)

Reuters: ECB done with rate cuts as economy shows signs of life (24/07/13)

Reuters: BoE to turn to forward guidance as way ahead (24/07/13)

Bloomberg: G-20 Reaches for Growth as China Changes Lending Rules (22/07/13)

Reuters: Gilts fall as BoE united against more QE, Bernanke caps losses (17/07/13)

Bloomberg Column: The Next Phase of the Eurozone Crisis (15/07/13)

Financial Times: Equity rally curbed on wider global concerns (13/07/13)

Reuters: ECB FOCUS - Muddying the message on forward guidance (12/07/13)

Bloomberg: What's Good for U.S.-China-Japan Hurts Emerging Markets (09/07/13)

Reuters/Chicago Tribune: Analysis: Euro zone survival? Depends on where you work (03/07/13)

Financial Times: Equities and government bonds advance (26/06/13)

Reuters: No policy change at BoE as new chief takes helm (26/06/13)

Welt am Sonntag: Bernanke spricht, die Börse fällt (23/06/13)

Bloomberg: Rating Rules Mean Black Fridays for Bond Volatility (21/06/13)

Reuters News: Creeping mistrust stops euro zone banks lending to peers across block (21/06/13)

Reuters: Economic reality finally cracks global market fervor (27/05/13)

IBT: Asian Stock Markets Stressed (27/05/13)

WSJ: Spain Sells More Bonds Than Planned at Auction, Yields Nudge Up (23/05/13)

FT: Bernanke warns banks on excessive risk (10/05/13)

FT: Dollar surge overshadows S&P's record run (10/05/13)

Reuters: ECB won't cut deposit rate below zero - Poll (09/05/13)

FT: Markets shrug off weak data (24/04/13)

Bloomberg TV: Komileva Says U.S. Jobs Data to Show Economy Soggy (03/05/13)

Reuters: GLOBAL ECONOMY-Manufacturing data stokes fears of global spring swoon (23/04/13)

Reuters News: Cyprus seen raising risk to euro of new crisis flare-up (12/04/13)

Reuters News: Global economy muted again in 2013: Reuters polls (11/04/13)

Bloomberg TV: Komileva Sees Default Risks in Europe's Periphery (10/04/12)

WSJ.com: ECB Press Conference (04/04/13)

WSJ: New Signs Point to Deeper Europe Malaise (02/04/13)

Euronews: No jobs, no growth (02/04/13)

Reuters News: European manufacturing ebbs further in March (02/04/13)

Reuters News: Cyprus bailout not expected to be euro zone's last - Reuters Poll (28/03/13)

BBC 5 Live Wake Up to Money: Cyprus deal undermines euro convertibility; BBC Podcasts: Cyprus Bailout (26/03/2013)

Reuters News: Cyprus rescue raises new questions about euro's long-term survival (25/03/13)

BBC News: UK Budget (20/03/13)

Bloomberg TV: Eurozone Default Cycle is Not Over (19/03/2013)

BBC Radio 4 Today's Programme: Lena Komileva discusses the markets' reaction to the Cyprus deposit tax proposal, with Simon Jack (18/03/13)

CNBC: Cyprus Depositor Tax Will Not Restore Economic Sustainability (18/03/13)

FT Markets: Italian poll disarms the ECB’s big bazooka (27/02/13)

BBC News: UK loses top AAA credit rating for the first time sunce 1978. Breaking news with Chancellor George Osborne, shadow chancellor Ed Balls, BBC chief economics correspondent Hugh Pym and City economist Lena Komileva. (22/02/13)

Reuters Blog: Still not thinking the very thinkable on Britain’s future. Andy Bruce and Lena Komileva on UK GDP forecasts. (20/02/13)

Bloomberg's "The Hays Advantage": G+ Economics' Komileva Discusses G20 Message (15/02/2013)

Reuters News: Short-term euro rates fall after weak GDP data (14/02/13)

WSJ: European Financial Markets Recover, Eyes On European Central Bank (07/02/13)

Reuters: Unexpected drop in factory output dents sterling (9/10/13)

Reuters News: U.S. business bruised by budget fight (25/01/13)

WSJ: Payback of ECB Lending to Mark New Step Back to Normal (24/01/13)

Bloomberg: ECB to be repaid €137.2 billion in LTRO loans (24/01/13)

WSJ: Threat of Currency Wars/Davos (23/01/13)

Bloomberg guest column: Komileva on the need for Davos attendees to avoid a false sense of security (23/01/2013)

Reuters: Japan Easing, Eurozone Data May Offer Hope for World Economy (20/01/13)

WSJ: Euro Crisis - Two Cheers for Europe's Coherence (14/01/13)

Bloomberg Radio's Surveilance with Tom Keene: Komileva Says Cliff Is Symptom of `Deeper Disease', with Sarah Eisen and Ken Prewitt (02/01/13)

FT: UK Economists Survey 2013 (01/01/13)

The Washington Post with Bloomberg: Euro ends 2-year slump on Draghi backstop (29/12/12)

Tom Keene on Bloomberg Television's "Surveillance Midday”: Lena Komileva talks about the outlook for ECB policy, the debt crisis and its global impact, and the implications of a potential Greek exit from the euro (14/05/12)

Bloomberg Businessweek: Mark Carney - Shedding Light on Shadow Banking (18/11/12)

Bloomberg FX12 Summit: Lena Komileva discusses EMIR and regulatory challenges in FX Derivatives markets; available on Bloomberg (16/10/12)

CNBC: Lena Komileva, chief economist at G+ Economics, tells CNBC, "Spain will resist a bailout for as long as possible because of the politics involved." (08/10/12)

BBC Viewpoints: US Elections (05/11/12)

BBC World Service: Austerity vs Growth; Prof. Iain Beggs (LSE), Lena Komileva (G+ Economics), Sony Kapoor (Re-Define) and Stephanie Blankenburg (SOAS); with Stefanie Flanders, BBC Economics Editor (10/05/12)

Barron's: A Romance That Lingers On - US Treasuries still hold allure for investors (29/12/12)

Reuters: China, US factory data improves but global risks remain (15/12/12)

Reuters: UK government heading for political blow from debt downgrade (06/12/12)

Reuters: Spain Bond Sale Volume Below Maximum (05/12/12)

Reuters: Eyes on Spain as ECB readies bazooka (04/10/12)

Reuters Blogs: Don Rajoy de la Mancha: Spain's “quixotic” adventures (03/10/12)

Financial Times: How long can equities defy economic malaise? (27/09/12)

Bloomberg TV: Lena Komileva, chief economist at G+ Economics, talks about the Greek debt crisis and the country's future in the euro zone, with Maryam Nemazee on "The Pulse." (20/08/12)

BBC News: Germany's AAA credit rating on 'negative outlook': Jim' O'Neill of Goldman Sachs Asset Management and Lena Komileva of G+ Economics agree on the implications of the latest developments for the Eurozone (24/07/12)

BBC Radio 4: Lesley Curwen talks to Lena Komileva on the European market contagion and the outlook for policy (24/07/12)

WSJ: Mario Draghi's ECB Conference (04/10/12)

CNBC: The Euro is Breakable: Lena Komileva, chief economist at G+Economics: "The euro is breakable, maybe not now, but certainly not never” (23/07/12)

BBC 5 Live's "Wake up to Money": A European Tipping Point? As the eurozone crisis continues Germany is threatened with a possible downgrade of its triple A-rated economy, Greece is bracing itself for an audit by its lenders and Spain and Italy have banned short-selling of shares. Lena Komileva talks to Jemery Nailor (24/07/12)

Reuters: Euribor follows ECB policy rates to record lows (06/07/12)

Bloomberg “Economic Edge”: Lena Komileva discusses Libor, Spain, Greece, European policy and the future of the euro with Linda Yueh, Bloomberg Economics Editor, Simon Johnson, professor of finance at MIT Sloan School of Management and former chief IMF economist, and Vicky Pryce, former senior U.K. government adviser (20/07/12)

Financial Times: How Low Will Bond Yields Go? Lena Komileva predicts that the rally is Bunds is not over yet. (27/06/12)

Demand better!

Whatever the macro-risk financial climate, evolving international economic trends and financial interconnections can create actionable opportunities and real risk management demands. The art of successful investing is predicting the direction of macro risk travel >>>

In the news

Bloomberg Opinion: Is the ECB Ready for its Credibility Test? (13/07/2021)

Bloomberg Opinion: Markets Are Ignoring the Main Driver of Today’s Inflation (10/06/21)

FT Opinion: Markets will soon pivot to focus on sustainability of recovery (25/03/2021)

Bloomberg Opinion | Economics: Public Debt Isn't the Problem, Soaring Deficits Are (15/03/2021)

FT: ECB pledges to step up pace of stimulus to counter market sell-off (11/03/2021)

Bloomberg TV: 2021 Will be the `Bounce Back' Year for Inflation - January is shaping up to be a pivotal month in determining whether the nascent U.S. reflation trade can really gather steam in 2021. "Every single bit of the market is telling us that there is an excess of financial overhang of inflation that's just waiting to ripen as we move out of the pandemic," G+ Economics Managing Partner & Chief Economist Lena Komileva said on "Bloomberg Markets: European Open." (04/01/2021)

Bloomberg TV: G+ Economics Chief Economist Lena Komileva on Brexit Deal - G+ Economics Managing Partner & Chief Economist Lena Komileva speaks to Bloomberg about the historic post-Brexit deal and what it means for both the EU and the U.K. (24/12/2020)

Bloomberg Opinion | Economics: The Case for Keeping Europe’s Negative Rates Where They Are, Komileva writes for Bloomberg Opinion (14/12/2020)

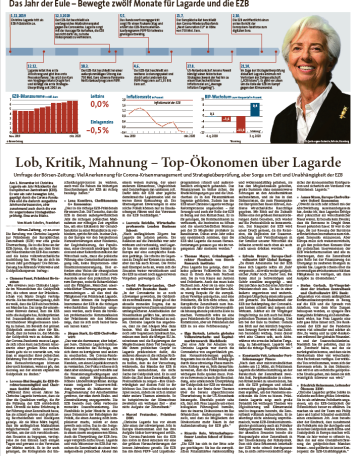

Börsen-Zeitung: Top Eurozone economists interviewed for President Lagarde's 1 Year anniversary (27/10/2020)

FT: Fraying ECB consensus poses diplomatic challenge for Lagarde (05/10/2021)

FT: ECB chief economist warns against complacency over recovery (11/09/2020)

Bloomberg TV: Lena Komileva gives her reaction to ECB President Lagarde’s policy press conference and the latest standoff in UK-EU Brexit negotiations. She speaks to Vonnie Quinn on Bloomberg TV (10/09/2020)

FT: ECB to monitor rise of euro after keeping rates on hold (10/09/2020)

FT: ECB to buy up ‘fallen angel’ bonds to cushion euro zone economy - Economists warn over plan to expand €750bn programme to include riskier debts (26/04/2020)

FT Long View: Mind the gap between the markets and the real economy (18/04/2020)

Market Talk Roundup: Coronavirus Removes Safety Net for Investors, G+ Economics Says (09/04/2020)

FT Market Forces: A chasm between Wall Street and economic winter (09/04/2020)

WSJ/Dow Jones: Coronavirus Removes Security of Central Bank Aid, G+ Economics Says -- Market Talk

Investors Must Learn to Reprice Assets After Pandemic -- Market Talk

Sustained Recovery Seen a Long Way Off -- Market Talk

Coronavirus Hit an Already Fragile Economy, G+ Economics Says -- Market Talk

Pandemic Amplifies Cracks in Financial System -- Market Talk

Scope for 'New Level of Entrepreneurship' After Crisis -- Market Talk (09/04/2020)

International Financing Review: Fed launches repo program for foreign central banks (31/03/2020)

Bloomberg TV: Global Economy Set for Battering Not Seen in Decades - The coronavirus pandemic is not a "black swan" so much as "a series of extraordinary events that have opened up several lines of global systemic fragility," according to Lena Komileva, chief economist at G Plus Economics. She speaks to Anna Edwards on "Bloomberg Markets: European Open." (25/03/2020)

FT Market Forces: Softening the blow is not a cure (18/03/2020)

FT Market Forces: A fiscal and monetary prescription (11/03/2020)

FT: Lagarde to confront coronavirus crisis at ECB policy meeting (09/03/2020)

FT: Fed decision to go it alone bucks history of collaboration (05/03/2020)

FT Market Forces: Failing to calm the churning waters (03/03/2020)

FT: Investors seek clues on new thinking as Lagarde launches ECB review (23/01/2020)

FT: ECB’s new faces give investors pause for thought over policy shifts (13/01/2020)

FT: Eurozone economy set to slow further in 2020 — FT poll (26/12/2019)

FT poll: Christine Lagarde expected to change ECB inflation target (22/12/2019)

Bloomberg Surveillance: Stocks, bonds, currencies and commodities. Lena Komileva joins Francine Lacqua in London and Tom Keene in New York. (12/12/2019)

FT Market Forces: Jamming the pause button for an extended period (11/12/2019)