(g+)economics in the news (continued)

Khaleej Times (UAE): Europe needs a fresh shot of ideas to flourish (09/11/2019)

CNBC.com: Sterling falls after Bank of England split on interest rate cut (07/11/2019)

Politico.EU: Lagarde’s political bent leaves critics fearingfor ECB independence (04/11/2019)

FT: ECB vows to hold rates at historic low until inflation picks up (24/10/2019)

Investing.com: Oil Ends Near Flat; Trade War Trumps Kurdish Conflict (08/10/2019)

FTSE 100 finishes higher on Friday as US jobs report brightens the mood (04/10/2019)

Yahoo Finance: Gold Steadies as Powell’s Inflation Quest Offsets Encouraging Jobs Report (04/10/2019)

FT Market Forces: Awaiting a hawkish delivery (17/09/2019)

BBC Radio 4 Today programme: “ECB to do whatever it takes” - Lena Komileva, chief economist and managing director of G+ Economics, discusses what the ECB is likely to do, when interest rates are already negative. "There is a general agreement that the ECB has to follow up on reassuring words with action, a broad range of a blend of action, rates, asset purchases, guidance, a promise to do what ever it takes - again. It's clear that the ECB's toolkit is rather maxed out," she told BBC Radio 4's Today Programme.(12/09/2019)

Investing.com: Sterling Struggles to Hold Gains after U.K. Jobs Report (10/09/2019)

Germany’s Boersen Zeitung: “Rezessionsangste schuren Debatte uber Konjunkturstutze / Recession fears spur debate about economic stimulus” Lena Komileva speaks to Germany’s Boersen Zeitung chief economics correspondent Mark Schrörs together with Lucrezia Reichlin, Stefan Kooths, Stefan Schneider and Christoph Schmidt (23/08/2019)

Bloomberg Businessweek: What a Yield-Curve Inversion Really Says About the U.S. Economy. A reliable recession indicator has lost some of its power to predict. (22/08/2019)

FT: Germany confronts growing risk of economic slowdown (13/08/2019)

Bloomberg TV: Komileva Says Wall of Liquidity Is Hitting Capital Markets (17/07/2019)

Investing.com: Forex - Dollar Drops as Commodity Currencies Shine on Rate Outlook (12/07/2019)

WSJ Real-Time Economics Special Edition: U.S. Hiring Rebounds (05/07/2019)

In my closing address to the 2019 #FXBUYSIDE Europe Summit I argued that markets face a web of geo-economic risks:

— Lena Komileva (@komileva) June 17, 2019

- Politics of debt

- Politics of FX

- Politics of protectionism

The war b/n reflationary fiscal deficits & contractionary econ wars will determine the growth outlook pic.twitter.com/rgoN4C0Pff

WSJ Pro: Where Do Markets Go From Here? Rally or Collapse, Warns Economist, From uncertainty to unpredictability, says G+ Economics By Jessica Fleetham (28/06/2019)

Bloomberg TV: Best Place Is in Cash at the Moment, Says G Plus Economics’s Komileva (10/06/2019)

Marketwatch: Why the path for stocks and other markets now depend ‘critically on politics’ (10/06/2019)

Bloomberg News: Stocks Advance, Peso Surges on Mexico Trade Relief (09/06/2019)

CNBC.com: German auto sector could drop as much as 12% if Trump announces tariffs, analyst says (15/05/2019)

Bloomberg TV: We Are in Extremely Binary Markets at the Moment, Says G Plus Economics’s Komileva (25/04/2019)

MarketWatch: How far can stocks rally on dovish Fed? It depends on the data (31/01/2019)

FT Market Forces: A weaker dollar favours risk appetite (31/01/2019)

Bloomberg TV: Komileva, Todd on the Future of Brexit (16/01/2019)

FT Market Forces: Investors in thrall of the market tug of war (07/01/2019)

FT Market Insight: Market challenge for the Fed is just beginning (07/01/2019)

FT Market Forces: A weaker dollar favours risk appetite (31/01/2019)

FT Market Forces: Investors in thrall of the market tug of war (07/01/2019)

Bloomberg Radio: Komileva says Tensions Between US and China Run Deep (03/12/2018)

FT: G20 caution leaves US stocks treading water (30/11/2018)

FT Market Forces: Ending November with markets stuck on hold (30/11/18)

MarketWatch: As Lighthizer predicts ‘success’ in Trump-Xi dinner, here’s what such an outcome might look like (30/11/2018)

FT: Wall St debates two words in Powell speech: 'just below' (28/11/2018)

EFE: La incertidumbre del Brexit pone en jaque a la economía británica (25/11/2018)

Bloomberg News: Pound Plunge Was Mere Prelude to What May Happen With No Deal (16/11/2018)

MarketWatch: Here's how Brexit turmoil could become a problem for US and global markets (16/11/2018)

FT: A Congress divided: Analysts explain what it means for Wall Street (07/11/2018)

FT: Dollar drops as midterm results dim stimulus hopes (07/11/2018)

MarketWatch: As election clouds clear, get ready for the rush back into US stocks (07/11/2018)

CNBC: Tax cuts have been controversial, but voters didn't seem to care about them (07/11/2018)

FT Market Forces: Gridlock - no escape from trade tension (06/11/18)

Bloomberg Radio: Bloomberg Daybreak with Karen Moskow and Nathan Hager (23/10/18)

Bloomberg TV: Fed Should Be Proceeding Towards Normalization Says G Plus' Komileva (04/07/18)

Reuters: Yields drop as US-China trade tension mounts (19/06/18)

Bloomberg TV: UK Parliament Set for Vote to Decide Brexit End Game (18/06/18)

Bloomberg: Taper Without the Tantrum as Draghi Pulls Off Virtuoso Performance (14/06/18)

FT: Euro under pressure as ECB delivers ‘dovish taper’ (14/06/18)

Bloomberg TV: Komileva says happy to let US economy run hot. Lena Komileva, chief economist at G Plus Economics, discusses Federal Reserve policy and inflation. She speaks on "Bloomberg Surveillance." (28/05/18)

FT: Dollar near 2018 highs ahead of Fed meeting (01/05/18)

Reuters: After Carney surprise, chance of May BoE rate hike down but not out (25/04/18)

Barron’s “Up and Down Wall Street”: Does the Flattening Yield Curve Signal a Recession? (21/04/18)

FT: Fed’s rate signals belie benign financial conditions (22/03/18)

FT: US stocks gain traction on signs of North Korea progress (06/03/18)

Bloomberg Prophets: The Rules of the Game Are Changing for Investors (16/02/18)

Financial Times Insight: Why volatility is here to stay (12/02/18)

FT: European stocks on track for worst week in two years (09/02/18)

FT: US stocks may find support as S&P 500 tests key level (09/02/18)

FT: S&P 500 in correction territory as sell-off continues (08/02/18)

MarketWatch: Stock-market melt-up takes a timeout as bond yields rise (03/02/18)

Business Insider: Wall Street is watching a key recession indicator that keeps flashing (19/01/18)

Bloomberg Opinion | Prophets: The Fed Is Losing Control of the Financial Markets (16/01/2018)

Asset TV: Masterclass Global Outlook - 2018

FT: Wall Street struggles to extend new year rally (08/01/2018)

Bloomberg TV: What are the biggest risks facing markets in 2018? (01/01/2018)

Bloomberg Best - Radio: The outlook for 2018 (28/12/2017)

Bloomberg TV: Komileva Says Markets in State of “Rational Exuberance” (28/12/2017)

Bloomberg Opinion | Prophets: Stocks and Bonds Are Sending the Correct Signals (15/12/2017)

WSJ: As Fed Tightens, Europe Hangs Loose (14/12/2017)

FT: Yellen kept markets calm but 2018 may be rockier (13/12/2017)

Bloomberg TV: G+’ Komileva Says BOE Is in 'Holding Period' on Rates (13/12/2017)

Financial Times: High-stakes game of financial risk for policymakers - Cracks appearing as fears grow central bank tightening could provoke market instability (28/11/2017)

Milano Finanza: May in limbo, pound under pressure (14/11/2017)

Dow Jones Newswires: BoE Risks Weak Growth, High Inflation, After Rate Rise: G+ Economics (14/11/ 2017)

Dow Jones Newswires: Sterling Price Doesn't Reflect "Extreme" Scenarios - Market Talk (13/11/2017)

5 Mega-Trends that will Define the Future of #Finance - outlined by @komileva

— CFA Institute® (@CFAinstitute) November 16, 2017

1. Macro-Market Liquidity and Cost of Risk

2. Demographics, Productivity and Economic Imbalances

3. Debt

4. Geopolitics of De-globalisation

5. Regulation and Systemic Risk #EICBerlin @FutureFinance pic.twitter.com/dqJYrdRWfU

Finance as a dynamic system: how are we going to get ready for a world of constant change? asks Lena @komileva at the European Investment Conference #EICBerlin pic.twitter.com/CMFrwjrOia

— CFA Institute® (@CFAinstitute) November 16, 2017

MarketWatch: Here’s why investors look too complacent about the Powell Fed (14/11/2017)

Barron’s: How the Powell Fed Will Be Tested (11/11/2017)

FT: “Continuity candidate” Powell still leaves questions for investors (03/11/2017)

DowJones Newswires: ECB Must Strike Right Balance in Scaling Back Bond Purchases (24/10/2017)

FT: The ECB and the Fed find themselves at the opposite ends of an exchange rate move that neither of them wants (08/09/2017)

Bloomberg: Draghi's Soft Euro Talk Suggests He's Holding Back the Magic (07/09/2017)

WSJ: ECB Weighs Ending Stimulus as Fed Calibrates Its Easy Money Stance (07/09/2017)

Dow Jones Newswires: Mario Draghi Says ECB Held Talks on Future of Stimulus (07/09/2017)

WSJ: ECB Weighs Ending Stimulus as Fed Calibrates Its Easy Money Stance (07/09/2017)

FT: Euro rally pushes chances of ECB rate hike to lowest on record (04/09/2017)

BBC Radio 4 Today: Eurozone looking healthy (01/09/2017)

#r4today business: @kiergroup CEO on #brexit, careers & margins @komileva on #Eurozone @jamesbevan_ccla = markets https://t.co/Oogcji9sKG

— Lucy Burton (@lucyburton) September 1, 2017

Investing.com: Are central banks blowing a bond bubble? (21/08/2017)

Financial Times Auther's Note: Better left unsaid (26/08/2017)

DJ News: Janet Yellen and Mario Draghi Warn Against Regulatory Cuts, Trade Moves (26/08/2017)

Dow Jones: Draghi Holds Off on Monetary Policy Clues, Criticizes Deregulation Push (25/08/2017)

FT: Euro above $1.19 after Draghi’s Jackson Hole speech (25/08/2017)

FT Insight: You are too complacent (31/07/17)

Bloomberg TV: G Plus' Komileva - Markets Unprepared for Normalization (10/08/2017)

CNBC: Markets ‘married to 1987’ economic models, should stop looking back 20 years, respond to new economy: Pro (04/08/2017)

FT: Dollar claws back early Fed-driven losses (27/07/17)

FT: Dollar finds support as attention turns to Yellen testimony (11/07/17)

WSJ: 投資者關注點從美聯儲轉向歐洲央行後者暗示退出刺激政策- 華爾街日報 (11/07/17)

Los inversores esperan que el Banco Central Europeo siga el camino de la Fed (11/07/17)

Reuters: Euro zone bond yields resume rise as focus shifts to Fed's unwind (11/07/17)

FT: US stocks and dollar find support from jobs report (07/07/17)

FT: Markets are missing the real message from central banks (06/07/17)

Reuters: Wie sage ich es den Märkten? EZB & Co bereiten Wende vor (05/07/17)

FT Global Markets Overview: Pound holds above lows as Brexit talks begin (20/06/17)

Guardian: Markets slide after weak UK retail sales and interest rate split (15/06/17)

Bloomberg: End of U.K. Austerity Looms After Voters Reject May (13/06/17)

MarketWatch: The ECB just took a ‘baby step’ toward reducing stimulus (08/06/17)

WSJ: European Central Bank holds line on monetary stimulus (29/05/17)

MarketWatch: FTSE 100 wobbles with OPEC decision in focus; British growth slows (25/05/2017)

BBC News: UK economy grows by 0.3% as service sector slows (28/04/17)

Bloomberg: Draghi Sets ECB Up for Six Weeks of Chatter (27/04/17)

Il Sole 24 Ore: Draghi: il Qe va avanti, inflazione ancora bassa (27/04/2017)

WSJ: ECB Gives No Indication It's Ready to End Easy Money (27/04/17)

Bloomberg TV: G+' Komileva Sees No Market Slowdown on Horizon (26/04/17)

Reuters: As France votes, Le Pen still worries markets more than the 90 percent taxman (20/04/2017)

FT: Stocks retreat amid earnings and geopolitical concerns (19/04/17)

Sky News – Ian King: UK retail sales fall as inflation bites (11/04/17)

Bloomberg TV: G+' Komileva Says Fed Stance Extremely Accommodative (28/03/17)

The Guardian: Stocks rise but dollar slides after Federal Reserve raises US interest rates - as it happened (15/03/17)

FT: Dollar under pressure after US jobs report (11/03/17)

MarketWatch: Central banks are taking off the market’s training wheels ECB’s gentle nudge shows just how dominant monetary policy has been in last half decade: Komileva (10/03/17)

Bloomberg TV: G+ Economics' Komileva Says Markets Living in Bubble (08/03/17)

FT Blogs: Spring Budget speech 2017 - as it happened (08/03/17)

DJ/WSJ: As Eurozone Economy Strengthens, Divisions Within ECB Re-emerge (07/03/17)

InsuranceAge: UK Broker Summit 2017: Economist advises brokers to prepare (02/03/2017)

FT: Markets checklist for March: Yellen, NFPs, FOMC, ECB, Dutch elections, “Brexit” Article 50 (28/02/2017)

FT: Global stocks at record highs as financials gain (15/02/17)

FT: Dollar index sinks to 2.5-month low, while gold shines (02/02/2017)

Bloomberg TV: Komileva: Markets Are at an Important Transition Point. Lena Komileva, G Plus Economics chief economist, discusses investor reaction to President Donald Trump's policies. (30/01/2017)

Bloomberg TV: How Important Are U.S. Trade Relations to the U.K.? (30/01/2017)

MarketWatch: Stock market closes lower, spooked by Trump immigration ban (30/01/17)

BBC World Service Business Daily - 2017: Prepare for Anything

BBC Radio 4 Today: What will 2017 hold for the economy? What will 2017 hold for the economy? Brexit, Trump and EU elections may shape the answer. Johanna Kyrklund of Schroders, Gilles Moec of Bank of America Merrill Lynch, and Lena Komileva of G+Economics discuss (03/01/17)

Bloomberg Surveillance: Komileva - Can Europe Survive in Its Current Form? (23/12/16)

Bloomberg Surveillance: Komileva -Europe Banking System Remains Fault Line? (23/12/16)

Fortune: Here's Why the Dollar Just Hit a 14-Year High (16/12/16)

FT: Dollar and Treasury yields jump on Fed rate outlook (15/12/16)

Reuters: Yields advance on fed rate hike outlook (15/12/16)

FT: S&P 500 touches record high as crude prices jump (13/12/16)

The Guardian: Oil price surges on cuts deal, Italian banks recover (12/12/16)

Il Sole 24 Ore: Questo non è (ancora) un tapering (09/12/16)

FT: ECB policy decision sparks volatility for euro and government bonds (08/12/16)

MarketWatch: FTSE 100 ends at 5-week high after ECB decision (08/12/16)

The Guardian: ECB’s Draghi announces stimulus extension (08/12/16)

FT: Wall Street hesitant after US jobs report (02/12/16)

FT: November’s jobs report: ‘Disappearing’ US wage growth (02/12/16)

Bloomberg TV: Why 2016 is the Year of Financial Impossibilities (30/11/16)

FT: Big market question: has it been too far, too fast post-Trump? (20/11/16)

WSJ: Markets May Soon Fall in Line With Fed's 2017 Rate-Hike Plan (16/11/16)

CNBC: Europe frets about what to do with Trump … but it’s got worries of its own (14/11/16)

FT: Talk of ECB QE wind-down weighs on Bunds (05/10/16)

Bloomberg TV: What Could Make the Fed Move Before December? (04/10/16)

Bloomberg TV: Does ECB Easing Pose a Risk to Bond Investments? (04/10/16)

Bloomberg TV: Brexit Timeline Clarifies but the Warnings Keep Coming (04/10/16)

MarketWatch: Here’s why the Bank of Japan is putting its focus on the yield curve (21/09/16)

Reuters News: FX, money market kinks fuel dollar bond issuance bonanza from Japan (21/09/16)

Bloomberg News: Fed Deluge of Dots and Discord Leaves Global Markets Baffled (13/09/16)

Il Sole 24 Ore: Draghi tiene in pausa il nuovo QE (09/09/16)

FT: Euro firmer on lack of QE extension talk (08/09/16)

The Guardian: Business Live (08/09/16)

Nasdaq: FTSE 100 Rises, Supported By Commodity, Bank Stocks (08/09/16)

Bloomberg TV: G-20 Remains a Vital Forum for Debate, Says Komileva (06/09/16)

Bloomberg TV: ECB Likely to Extend QE Into 2018, Says Komileva (06/09/16)

Bloomberg TV: Is This the Beginning of the End for Merkel? (06/09/16)

Bloomberg TV: Have Markets Priced in an Oil Production Freeze? (06/09/16)

MarketWatch: Why the Fed needs to stop ‘back seat’ driving, in one chart (02/09/16)

FT: Stocks bolstered by mild US jobs report (02/09/16)

MarketWatch: US stocks end higher after payroll report (02/09/16)

Demand better!

Whatever the macro-risk financial climate, evolving international economic trends and financial interconnections can create actionable opportunities and real risk management demands. The art of successful investing is predicting the direction of macro risk travel >>>

In the news

Bloomberg Opinion: Is the ECB Ready for its Credibility Test? (13/07/2021)

Bloomberg Opinion: Markets Are Ignoring the Main Driver of Today’s Inflation (10/06/21)

FT Opinion: Markets will soon pivot to focus on sustainability of recovery (25/03/2021)

Bloomberg Opinion | Economics: Public Debt Isn't the Problem, Soaring Deficits Are (15/03/2021)

FT: ECB pledges to step up pace of stimulus to counter market sell-off (11/03/2021)

Bloomberg TV: 2021 Will be the `Bounce Back' Year for Inflation - January is shaping up to be a pivotal month in determining whether the nascent U.S. reflation trade can really gather steam in 2021. "Every single bit of the market is telling us that there is an excess of financial overhang of inflation that's just waiting to ripen as we move out of the pandemic," G+ Economics Managing Partner & Chief Economist Lena Komileva said on "Bloomberg Markets: European Open." (04/01/2021)

Bloomberg TV: G+ Economics Chief Economist Lena Komileva on Brexit Deal - G+ Economics Managing Partner & Chief Economist Lena Komileva speaks to Bloomberg about the historic post-Brexit deal and what it means for both the EU and the U.K. (24/12/2020)

Bloomberg Opinion | Economics: The Case for Keeping Europe’s Negative Rates Where They Are, Komileva writes for Bloomberg Opinion (14/12/2020)

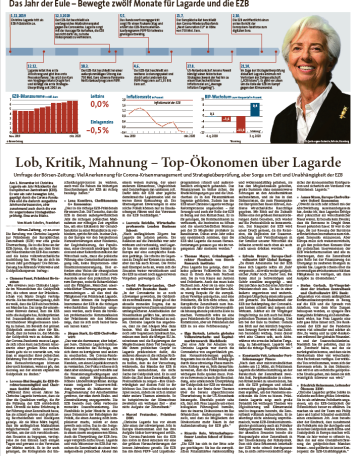

Börsen-Zeitung: Top Eurozone economists interviewed for President Lagarde's 1 Year anniversary (27/10/2020)

FT: Fraying ECB consensus poses diplomatic challenge for Lagarde (05/10/2021)

FT: ECB chief economist warns against complacency over recovery (11/09/2020)

Bloomberg TV: Lena Komileva gives her reaction to ECB President Lagarde’s policy press conference and the latest standoff in UK-EU Brexit negotiations. She speaks to Vonnie Quinn on Bloomberg TV (10/09/2020)

FT: ECB to monitor rise of euro after keeping rates on hold (10/09/2020)

FT: ECB to buy up ‘fallen angel’ bonds to cushion euro zone economy - Economists warn over plan to expand €750bn programme to include riskier debts (26/04/2020)

FT Long View: Mind the gap between the markets and the real economy (18/04/2020)

Market Talk Roundup: Coronavirus Removes Safety Net for Investors, G+ Economics Says (09/04/2020)

FT Market Forces: A chasm between Wall Street and economic winter (09/04/2020)

WSJ/Dow Jones: Coronavirus Removes Security of Central Bank Aid, G+ Economics Says -- Market Talk

Investors Must Learn to Reprice Assets After Pandemic -- Market Talk

Sustained Recovery Seen a Long Way Off -- Market Talk

Coronavirus Hit an Already Fragile Economy, G+ Economics Says -- Market Talk

Pandemic Amplifies Cracks in Financial System -- Market Talk

Scope for 'New Level of Entrepreneurship' After Crisis -- Market Talk (09/04/2020)

International Financing Review: Fed launches repo program for foreign central banks (31/03/2020)

Bloomberg TV: Global Economy Set for Battering Not Seen in Decades - The coronavirus pandemic is not a "black swan" so much as "a series of extraordinary events that have opened up several lines of global systemic fragility," according to Lena Komileva, chief economist at G Plus Economics. She speaks to Anna Edwards on "Bloomberg Markets: European Open." (25/03/2020)

FT Market Forces: Softening the blow is not a cure (18/03/2020)

FT Market Forces: A fiscal and monetary prescription (11/03/2020)

FT: Lagarde to confront coronavirus crisis at ECB policy meeting (09/03/2020)

FT: Fed decision to go it alone bucks history of collaboration (05/03/2020)

FT Market Forces: Failing to calm the churning waters (03/03/2020)

FT: Investors seek clues on new thinking as Lagarde launches ECB review (23/01/2020)

FT: ECB’s new faces give investors pause for thought over policy shifts (13/01/2020)

FT: Eurozone economy set to slow further in 2020 — FT poll (26/12/2019)

FT poll: Christine Lagarde expected to change ECB inflation target (22/12/2019)

Bloomberg Surveillance: Stocks, bonds, currencies and commodities. Lena Komileva joins Francine Lacqua in London and Tom Keene in New York. (12/12/2019)

FT Market Forces: Jamming the pause button for an extended period (11/12/2019)