G+ Macro Risk Analysis

Global Perspectives : Strategic Macro Guidance : Comprehensive Insight

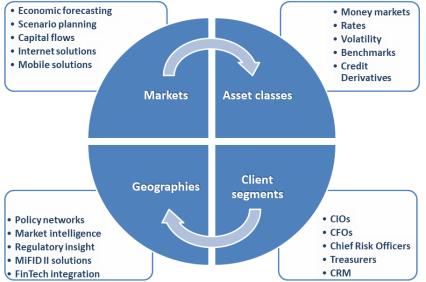

The art of investment is combining a top-down network approach with a bottom-up model-based understanding of economic interactions.

We deliver industry-leading economic insight on where the returns lie and what the risks are, through client-driven consultancy at market cost.

Our research and consultancy service is founded on three fundamental pillars:

- Deep-dive market expertise backed by experience

- Consensus-leading policy foresight

- Interconnected macro-economic, monetary and financial analysis

Our market economics proposition is unique in the independent economic research world. It has become an industry benchmark, disrupting traditional disconnected research specialisms in an interconnected and reflexive global financial eco-system.

Our track record of outperforming institutional analytical models spans over two decades. It is built on accurate market analysis, consensus-leading policy predictions and timely foresight on the drivers and consequences of the Global Financial Crisis, across core economies, public finances, central bank policy and asset class themes.

Our depth is not measured by the ammount of detail we include in our research but by the longevity and impact of our core convictions. Our research is regularly flagged by clients as a guide for future thought development. We are committed to our proposition of economic rigour, market scope and research value.

Client service

An established track record and strong client relationships based on trust contribute half of the success of a macro-financial research product. The other half is less visible but crucial – market competence, analytical performance and client process functionality. That’s what makes a valuable client service.

Consensus-leading market economics intelligence at your fingertips:

g+Exchange An interactive network of insights on key market, policy and macro developments.

g+ThinkLab Clients deliver a topical or thematic issue for research and debate.

g+Challenge Forums and meetings with leading policy experts to discuss investment themes, refine investment thought processes, challenge market theses, and launch new ideas.

MiFID II and institutional relations

In a MiFID II unbundled-research world, traditional investment insight delivery channels are becoming disrupted. New aggregator models encourage increased supply traffic, driving up opportunity costs for clients as subscription costs are locked in.

At the same time, traditional dealer research providers are cutting back on research cost and expert staffing, driving down quality, breadth and depth. Assuming a transparent bank pricing model, a typical research report would incur a client cost in the range of £1,350-2500 based on a two-analyst effort, or £55,000 per day based on a typical 40-analyst bank research group (2017 estimates). Potential disruption to meeting client research needs for the purpose of asset allocation decisions could be much costlier.

We have a different cost model and a direct application into clients’ treasury management and asset allocation decisions. Our clients to receive insight in a structured, auditable and transparent way, consistent with their own compliance obligations and the highest professional ethical standards.

Our fintech solutions mean that our clients are fully compliant with incoming regulation. Our clients’ efficiency gains are commensurate to the scale of market disruption and marginal compliance costs.

Lead the consensus

Demand better. Question the conventional wisdom of the day.

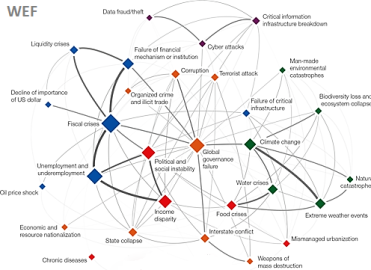

Whatever the macro-risk financial climate, the evolution of international economic trends and financial interconnections can alter macro-financial relationships. Our focus is on indentifying actionable opportunities, and real risks, across the economic, geopolitical, technological, environment and social spectrum.

The art of successful investing is predicting the direction of macro risk travel.

Demand better!

Whatever the macro-risk financial climate, evolving international economic trends and financial interconnections can create actionable opportunities and real risk management demands. The art of successful investing is predicting the direction of macro risk travel >>>

In the news

Bloomberg Opinion: Is the ECB Ready for its Credibility Test? (13/07/2021)

Bloomberg Opinion: Markets Are Ignoring the Main Driver of Today’s Inflation (10/06/21)

FT Opinion: Markets will soon pivot to focus on sustainability of recovery (25/03/2021)

Bloomberg Opinion | Economics: Public Debt Isn't the Problem, Soaring Deficits Are (15/03/2021)

FT: ECB pledges to step up pace of stimulus to counter market sell-off (11/03/2021)

Bloomberg TV: 2021 Will be the `Bounce Back' Year for Inflation - January is shaping up to be a pivotal month in determining whether the nascent U.S. reflation trade can really gather steam in 2021. "Every single bit of the market is telling us that there is an excess of financial overhang of inflation that's just waiting to ripen as we move out of the pandemic," G+ Economics Managing Partner & Chief Economist Lena Komileva said on "Bloomberg Markets: European Open." (04/01/2021)

Bloomberg TV: G+ Economics Chief Economist Lena Komileva on Brexit Deal - G+ Economics Managing Partner & Chief Economist Lena Komileva speaks to Bloomberg about the historic post-Brexit deal and what it means for both the EU and the U.K. (24/12/2020)

Bloomberg Opinion | Economics: The Case for Keeping Europe’s Negative Rates Where They Are, Komileva writes for Bloomberg Opinion (14/12/2020)

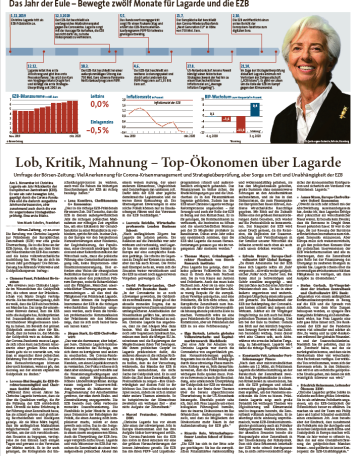

Börsen-Zeitung: Top Eurozone economists interviewed for President Lagarde's 1 Year anniversary (27/10/2020)

FT: Fraying ECB consensus poses diplomatic challenge for Lagarde (05/10/2021)

FT: ECB chief economist warns against complacency over recovery (11/09/2020)

Bloomberg TV: Lena Komileva gives her reaction to ECB President Lagarde’s policy press conference and the latest standoff in UK-EU Brexit negotiations. She speaks to Vonnie Quinn on Bloomberg TV (10/09/2020)

FT: ECB to monitor rise of euro after keeping rates on hold (10/09/2020)

FT: ECB to buy up ‘fallen angel’ bonds to cushion euro zone economy - Economists warn over plan to expand €750bn programme to include riskier debts (26/04/2020)

FT Long View: Mind the gap between the markets and the real economy (18/04/2020)

Market Talk Roundup: Coronavirus Removes Safety Net for Investors, G+ Economics Says (09/04/2020)

FT Market Forces: A chasm between Wall Street and economic winter (09/04/2020)

WSJ/Dow Jones: Coronavirus Removes Security of Central Bank Aid, G+ Economics Says -- Market Talk

Investors Must Learn to Reprice Assets After Pandemic -- Market Talk

Sustained Recovery Seen a Long Way Off -- Market Talk

Coronavirus Hit an Already Fragile Economy, G+ Economics Says -- Market Talk

Pandemic Amplifies Cracks in Financial System -- Market Talk

Scope for 'New Level of Entrepreneurship' After Crisis -- Market Talk (09/04/2020)

International Financing Review: Fed launches repo program for foreign central banks (31/03/2020)

Bloomberg TV: Global Economy Set for Battering Not Seen in Decades - The coronavirus pandemic is not a "black swan" so much as "a series of extraordinary events that have opened up several lines of global systemic fragility," according to Lena Komileva, chief economist at G Plus Economics. She speaks to Anna Edwards on "Bloomberg Markets: European Open." (25/03/2020)

FT Market Forces: Softening the blow is not a cure (18/03/2020)

FT Market Forces: A fiscal and monetary prescription (11/03/2020)

FT: Lagarde to confront coronavirus crisis at ECB policy meeting (09/03/2020)

FT: Fed decision to go it alone bucks history of collaboration (05/03/2020)

FT Market Forces: Failing to calm the churning waters (03/03/2020)

FT: Investors seek clues on new thinking as Lagarde launches ECB review (23/01/2020)

FT: ECB’s new faces give investors pause for thought over policy shifts (13/01/2020)

FT: Eurozone economy set to slow further in 2020 — FT poll (26/12/2019)

FT poll: Christine Lagarde expected to change ECB inflation target (22/12/2019)

Bloomberg Surveillance: Stocks, bonds, currencies and commodities. Lena Komileva joins Francine Lacqua in London and Tom Keene in New York. (12/12/2019)

FT Market Forces: Jamming the pause button for an extended period (11/12/2019)