Legal notice

(g+)economics provides investment research and advisory services to prestigious institutions and professional investors worldwide. We are committed to providing the highest quality of service to our clients. We also have a responsibility to our clients, the public and our profession to deliver our services in a professional manner, with uncompromising values and standards. As such, we comply with all applicable laws, regulations and requirements regarding copyright, privacy and security.

Intellectual Property Rights

Any part of (g+)economics research, including verbal communication and related User content, website, charts, data and the trademarks, service marks and logos contained in its electronic and physical materials, and any other intellectual property, including without limitation any economic analysis, market strategy ideas, policy research and other copywrited information ("Content") are owned by or licensed to (g+)economics, subject to copyright and other intellectual property rights under United Kingdom, European Economic Area and foreign laws and international conventions. Content may not be copied, reproduced, distributed, transmitted, broadcast, displayed, sold, licensed, uploaded, or otherwise exploited without the prior written consent of (g+)economics. Further, any such dissemination that has received prior approval from (g+)economics must contain notice of (g+)conomics' copyright.

Privacy Policy

Registration data and certain other information about you you are subject to (g+)economics' Privacy Policy. We are committed to protecting your privacy and your non-public personal information. We do not sell or market your non-public personal information to unaffiliated organizations. We maintain physical, electronic and procedural safeguards to protect your privacy. (g+)economics' employees agree to and are bound by the Non-Disclosure provision of the Terms and Conditions outlined in the Client Service Schedule.

Limitations of Liabilities

The information and data contained in this website are derived from sources deemed reliable, but (g+)economics and respective suppliers do not guarantee the correctness or completeness of any data or other information furnished in connection with this website. To the maximum extent permitted by law, (g+)economics and their respective suppliers and third-party agents shall not be responsible for or have any liability for any injuries, including direct, incidental, punitive, special, consequential or exemplary damages that directly or indirectly result from the use of this website or the information contained in it or obtained from the use of its content.

Data Security

We have put in place appropriate security measures to prevent your personal data from being accidentally lost, used or accessed in an unauthorised way, altered or disclosed. In addition, we limit access to your personal data to those employees, agents, contractors and other third parties who have a business need to know. They will only process your personal data on our instructions and they are subject to a duty of confidentiality. We have in place procedures to deal with any suspected personal data breach and will notify you and any applicable regulator if a breach were ever to occur as soon as possible.

Demand better!

Whatever the macro-risk financial climate, evolving international economic trends and financial interconnections can create actionable opportunities and real risk management demands. The art of successful investing is predicting the direction of macro risk travel >>>

In the news

Bloomberg Opinion: Is the ECB Ready for its Credibility Test? (13/07/2021)

Bloomberg Opinion: Markets Are Ignoring the Main Driver of Today’s Inflation (10/06/21)

FT Opinion: Markets will soon pivot to focus on sustainability of recovery (25/03/2021)

Bloomberg Opinion | Economics: Public Debt Isn't the Problem, Soaring Deficits Are (15/03/2021)

FT: ECB pledges to step up pace of stimulus to counter market sell-off (11/03/2021)

Bloomberg TV: 2021 Will be the `Bounce Back' Year for Inflation - January is shaping up to be a pivotal month in determining whether the nascent U.S. reflation trade can really gather steam in 2021. "Every single bit of the market is telling us that there is an excess of financial overhang of inflation that's just waiting to ripen as we move out of the pandemic," G+ Economics Managing Partner & Chief Economist Lena Komileva said on "Bloomberg Markets: European Open." (04/01/2021)

Bloomberg TV: G+ Economics Chief Economist Lena Komileva on Brexit Deal - G+ Economics Managing Partner & Chief Economist Lena Komileva speaks to Bloomberg about the historic post-Brexit deal and what it means for both the EU and the U.K. (24/12/2020)

Bloomberg Opinion | Economics: The Case for Keeping Europe’s Negative Rates Where They Are, Komileva writes for Bloomberg Opinion (14/12/2020)

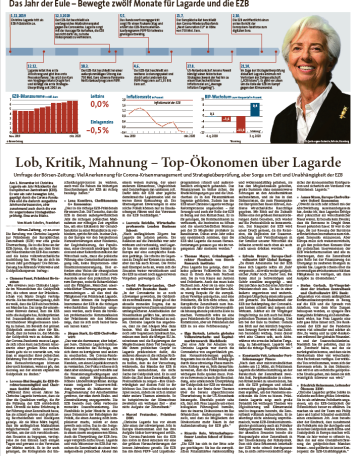

Börsen-Zeitung: Top Eurozone economists interviewed for President Lagarde's 1 Year anniversary (27/10/2020)

FT: Fraying ECB consensus poses diplomatic challenge for Lagarde (05/10/2021)

FT: ECB chief economist warns against complacency over recovery (11/09/2020)

Bloomberg TV: Lena Komileva gives her reaction to ECB President Lagarde’s policy press conference and the latest standoff in UK-EU Brexit negotiations. She speaks to Vonnie Quinn on Bloomberg TV (10/09/2020)

FT: ECB to monitor rise of euro after keeping rates on hold (10/09/2020)

FT: ECB to buy up ‘fallen angel’ bonds to cushion euro zone economy - Economists warn over plan to expand €750bn programme to include riskier debts (26/04/2020)

FT Long View: Mind the gap between the markets and the real economy (18/04/2020)

Market Talk Roundup: Coronavirus Removes Safety Net for Investors, G+ Economics Says (09/04/2020)

FT Market Forces: A chasm between Wall Street and economic winter (09/04/2020)

WSJ/Dow Jones: Coronavirus Removes Security of Central Bank Aid, G+ Economics Says -- Market Talk

Investors Must Learn to Reprice Assets After Pandemic -- Market Talk

Sustained Recovery Seen a Long Way Off -- Market Talk

Coronavirus Hit an Already Fragile Economy, G+ Economics Says -- Market Talk

Pandemic Amplifies Cracks in Financial System -- Market Talk

Scope for 'New Level of Entrepreneurship' After Crisis -- Market Talk (09/04/2020)

International Financing Review: Fed launches repo program for foreign central banks (31/03/2020)

Bloomberg TV: Global Economy Set for Battering Not Seen in Decades - The coronavirus pandemic is not a "black swan" so much as "a series of extraordinary events that have opened up several lines of global systemic fragility," according to Lena Komileva, chief economist at G Plus Economics. She speaks to Anna Edwards on "Bloomberg Markets: European Open." (25/03/2020)

FT Market Forces: Softening the blow is not a cure (18/03/2020)

FT Market Forces: A fiscal and monetary prescription (11/03/2020)

FT: Lagarde to confront coronavirus crisis at ECB policy meeting (09/03/2020)

FT: Fed decision to go it alone bucks history of collaboration (05/03/2020)

FT Market Forces: Failing to calm the churning waters (03/03/2020)

FT: Investors seek clues on new thinking as Lagarde launches ECB review (23/01/2020)

FT: ECB’s new faces give investors pause for thought over policy shifts (13/01/2020)

FT: Eurozone economy set to slow further in 2020 — FT poll (26/12/2019)

FT poll: Christine Lagarde expected to change ECB inflation target (22/12/2019)

Bloomberg Surveillance: Stocks, bonds, currencies and commodities. Lena Komileva joins Francine Lacqua in London and Tom Keene in New York. (12/12/2019)

FT Market Forces: Jamming the pause button for an extended period (11/12/2019)