Connecting the Dots

Videos : News : New Media : Articles

FT Opinion: The answer to inflation fears lies in ending Covid disruption

The structural legacy of Covid-19 will be with us long after the sugar rush of overstimulation of the economy by central banks and governments at a time of pent-up demand and restricted supply capacity has faded from view. Economies must adapt to supply changes, consumption patterns and labour dynamics. Financial Times, 07/07/2021

Bloomberg Opinion: Markets Are Ignoring the Main Driver of Today’s Inflation

Covid’s been nothing but a mega global structural shock. It’s so overwhelmingly different from the textbook economic cycle. As Lena Komileva explains in this column, in a rollercoaster cycle of expected vs realised economic risk, it’ll be wrong to think of macro volatility of 2020-2021 as the new normal.

Bloomberg TV: Global Economy Set for Battering Not Seen in Decades

The coronavirus pandemic is not a "black swan" so much as "a series of extraordinary events that have opened up several lines of global systemic fragility," according to Lena Komileva, chief economist at G Plus Economics. She speaks to Anna Edwards on "Bloomberg Markets: European Open." 25/03/2020

Bloomberg TV: Komileva - Why I'm Optimistic About Europe

Lena Komileva, managing director at G+ Economics, discusses the ECB's bond-purchase plan with Bloomberg's Anna Edwards and Mark Barton on "Countdown" (Source: Bloomberg)

(Please note link opens a new window)

Bloomberg TV: Markets Are Underpricing Rates Risk - Komileva

Ex-Goldman's Cohn, now President Trump's economic adviser says it would be wrong to think markets are ready for higher Fed rates. G Plus Economics Chief Economist and Managing Director Lena Komileva agrees. She speaks to Bloomberg's Anna Edwards on "Countdown." Source: Bloomberg

Bloomberg TV: The structural flipside of Christine Lagarde’s “new normal”

Tom Keene and Jonathan Ferro on "Bloomberg Surveillance": Lena Komileva, managing director at G+ Economics, discusses global worries about financial instability and how markets are driving central bank moves. (Source: Bloomberg)

The Big Read

Selected articles by Lena Komileva

Bloomberg Opinion: Is the ECB Ready for its Credibility Test?, Bloomberg, 13 July 2021

Financial Times Opinion: The answer to inflation fears lies in ending Covid disruption, Financial Times, 7 July 2021

Bloomberg Opinion: Markets Are Ignoring the Main Driver of Today’s Inflation - In a rollercoaster economic cycle, inflation is the temporary cost of Covid uncertainty, Bloomberg, 9 June 2021

Financial Times Opinion: Markets will soon pivot to focus on sustainability of recovery - The 'new post-Covid normal', after a historic symbiosis b/n fiscal & monetary policy, will challenge policymakers, Financial Times, 25 March 2021

Bloomberg Opinion: Public Debt Isn't the Problem, Soaring Deficits Are, Bloomberg, 15 March 2021

Bloomberg Opinion | Economics: The Case for Keeping Europe’s Negative Rates Where They Are - As the gap between the haves and have-nots has grown, the European Central Bank’s policy has been a great equalizer, Bloomberg, 14 December 2020

Also watch: Global Economy Set for Battering Not Seen in Decades - Coronavirus has revealed multiple systemic risks, Komileva says, Bloomberg TV, 25 March 2020

Financial Times Market Insight: Market challenge for the Fed is just beginning, Financial Times, 7 January 2019

Bloomberg Prophets: The Rules of the Game Are Changing for Investors, Bloomberg, 16 February 2018

Financial Times Insight: Why volatility is here to stay, Financial Times, 12 February 2018

Bloomberg Opinion | Prophets: The Fed Is Losing Control of the Financial Markets, Bloomberg, 16 January 2018

Bloomberg Opinion | Prophets: Stocks and Bonds Are Sending the Correct Signals, Bloomberg, 15 December 2017

Financial Times Insight: High-stakes game of financial risk for policymakers - Cracks appearing as fears grow central bank tightening could provoke market instability, Financial Times, 28 November 2017 (Sintra ECB Forum on Central Banking)

FT Opinion: You are too complacent, central banks warn markets,

Financial Times, 31 July, 2017 (Sintra ECB Forum on Central Banking)

Currency fireworks, global economic imbalances and the G20, Bloomberg View, 18 February, 2013

On the need for Davos attendees to avoid a false sense of security, Bloomberg View, 23 January, 2013

How long can equities defy economic malaise? Financial Times, September, 2012

How Low Will Bond Yields Go? Financial Times, June 2012

FT Video: "Credit and solvency are the problem, not liquidity, so bail-outs should be replaced with a focus on strengthening institutions and improving growth prospects", FT Interview, 2011

Libor volatility is price of disrupted credit, Financial Times, 23 August, 2010

Not a liquidity crisis, but a solvency one, Financial Times, 3 June, 2010

How to fix the liquidity leak, Financial Times, 2 February 2009

Can the capital markets rally reinvigorate the real economy? Financial Times, September 2009

How G20 can unfreeze credit and cut bailout costs, The Great Debate, Thomson Reuters, April 2009

Crash and carry, Lena Komileva predicts a sharp reversal of the global carry trade, FX Week, 17 March 2008

Read Lena Komileva's interview with Portugal’s Jornal de Negócios

Interview with Portugal’s Jornal de Negócios: Lena Komileva recognizes that the ECB's measures are already having an impact, but doubts that inflation is headed to 2% with full employment in the Eurozone.

Portugal CFA article.pdf

Adobe Acrobat document [841.9 KB]

Demand better!

Whatever the macro-risk financial climate, evolving international economic trends and financial interconnections can create actionable opportunities and real risk management demands. The art of successful investing is predicting the direction of macro risk travel >>>

In the news

Bloomberg Opinion: Is the ECB Ready for its Credibility Test? (13/07/2021)

Bloomberg Opinion: Markets Are Ignoring the Main Driver of Today’s Inflation (10/06/21)

FT Opinion: Markets will soon pivot to focus on sustainability of recovery (25/03/2021)

Bloomberg Opinion | Economics: Public Debt Isn't the Problem, Soaring Deficits Are (15/03/2021)

FT: ECB pledges to step up pace of stimulus to counter market sell-off (11/03/2021)

Bloomberg TV: 2021 Will be the `Bounce Back' Year for Inflation - January is shaping up to be a pivotal month in determining whether the nascent U.S. reflation trade can really gather steam in 2021. "Every single bit of the market is telling us that there is an excess of financial overhang of inflation that's just waiting to ripen as we move out of the pandemic," G+ Economics Managing Partner & Chief Economist Lena Komileva said on "Bloomberg Markets: European Open." (04/01/2021)

Bloomberg TV: G+ Economics Chief Economist Lena Komileva on Brexit Deal - G+ Economics Managing Partner & Chief Economist Lena Komileva speaks to Bloomberg about the historic post-Brexit deal and what it means for both the EU and the U.K. (24/12/2020)

Bloomberg Opinion | Economics: The Case for Keeping Europe’s Negative Rates Where They Are, Komileva writes for Bloomberg Opinion (14/12/2020)

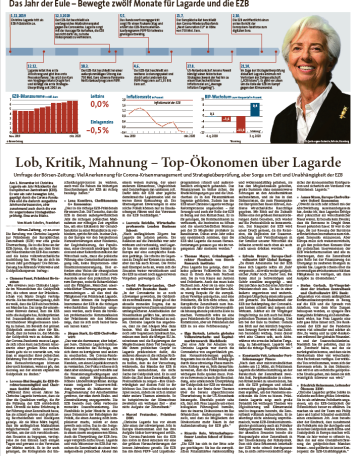

Börsen-Zeitung: Top Eurozone economists interviewed for President Lagarde's 1 Year anniversary (27/10/2020)

FT: Fraying ECB consensus poses diplomatic challenge for Lagarde (05/10/2021)

FT: ECB chief economist warns against complacency over recovery (11/09/2020)

Bloomberg TV: Lena Komileva gives her reaction to ECB President Lagarde’s policy press conference and the latest standoff in UK-EU Brexit negotiations. She speaks to Vonnie Quinn on Bloomberg TV (10/09/2020)

FT: ECB to monitor rise of euro after keeping rates on hold (10/09/2020)

FT: ECB to buy up ‘fallen angel’ bonds to cushion euro zone economy - Economists warn over plan to expand €750bn programme to include riskier debts (26/04/2020)

FT Long View: Mind the gap between the markets and the real economy (18/04/2020)

Market Talk Roundup: Coronavirus Removes Safety Net for Investors, G+ Economics Says (09/04/2020)

FT Market Forces: A chasm between Wall Street and economic winter (09/04/2020)

WSJ/Dow Jones: Coronavirus Removes Security of Central Bank Aid, G+ Economics Says -- Market Talk

Investors Must Learn to Reprice Assets After Pandemic -- Market Talk

Sustained Recovery Seen a Long Way Off -- Market Talk

Coronavirus Hit an Already Fragile Economy, G+ Economics Says -- Market Talk

Pandemic Amplifies Cracks in Financial System -- Market Talk

Scope for 'New Level of Entrepreneurship' After Crisis -- Market Talk (09/04/2020)

International Financing Review: Fed launches repo program for foreign central banks (31/03/2020)

Bloomberg TV: Global Economy Set for Battering Not Seen in Decades - The coronavirus pandemic is not a "black swan" so much as "a series of extraordinary events that have opened up several lines of global systemic fragility," according to Lena Komileva, chief economist at G Plus Economics. She speaks to Anna Edwards on "Bloomberg Markets: European Open." (25/03/2020)

FT Market Forces: Softening the blow is not a cure (18/03/2020)

FT Market Forces: A fiscal and monetary prescription (11/03/2020)

FT: Lagarde to confront coronavirus crisis at ECB policy meeting (09/03/2020)

FT: Fed decision to go it alone bucks history of collaboration (05/03/2020)

FT Market Forces: Failing to calm the churning waters (03/03/2020)

FT: Investors seek clues on new thinking as Lagarde launches ECB review (23/01/2020)

FT: ECB’s new faces give investors pause for thought over policy shifts (13/01/2020)

FT: Eurozone economy set to slow further in 2020 — FT poll (26/12/2019)

FT poll: Christine Lagarde expected to change ECB inflation target (22/12/2019)

Bloomberg Surveillance: Stocks, bonds, currencies and commodities. Lena Komileva joins Francine Lacqua in London and Tom Keene in New York. (12/12/2019)

FT Market Forces: Jamming the pause button for an extended period (11/12/2019)